The Big Picture

Decentralized finance is one of, if not the driving theme behind Blockchain & Co. Non-Fungible Tokens, or NFTs, is another driver.

In at least the last 5 published articles, I’ve talked about the potential of combining gamification and NFTs. I am convinced that the use of gamification in the service of NFTs and likewise the use of NFTs in the service of gamification have an exciting future.

If you are interested in this combination, you can find all about it here.

But if decentralized finance (DeFi) plays such a big role in the blockchain universe, what does it look like when DeFi meets NFTs meets Gamification? That’s what we’re looking at right now.

Part 1

What’s Happening

Decentralized finance means one thing above all: in theory, every single one of us now has access to a financial system. Because, firstly, you can now invest with as little as ten euros and, secondly, you can do so by and large without administrative or other hurdles.

Decentralized finance, or DeFi, is a system by which financial products become available on a public decentralized blockchain network. That makes them open to anyone to use, rather than going through middlemen like banks or brokerages. Unlike a bank or brokerage account, a government-issued ID, Social Security number, or proof of address are not necessary to use DeFi.

https://www.investopedia.com/decentralized-finance-defi-5113835

We will not explain DeFi in detail now because there are already truly very good articles for this. For example here or also this video. However, I will pick out one point here in order to be able to show an interesting interaction between DeFi and gamified NFTs on the basis of this one example.

This one point is the collateral.

Go Deeper with Gamified NFTs as Collaterals for DeFi

In the world of decentralized finance, there are different products. However, one thing remains the same compared to the traditional financial system. There is the party that provides financial liquidity and the other party that seeks or wants that liquidity, as to say, a loan.

And in order to be allowed to take out a loan, you also have to deposit collateral here. This is where some of the differences between decentralized finance and the traditional financial system start to become clear.

In the DEFI world, there are also new ways of depositing collateral. Basically, anything that is accepted as collateral by potential lenders and can be mapped in one way or another in the blockchain can now function as collateral.

Theoretically, this can also be, for example, pair of sneakers, which are traded on the market by collectors with a certain value.

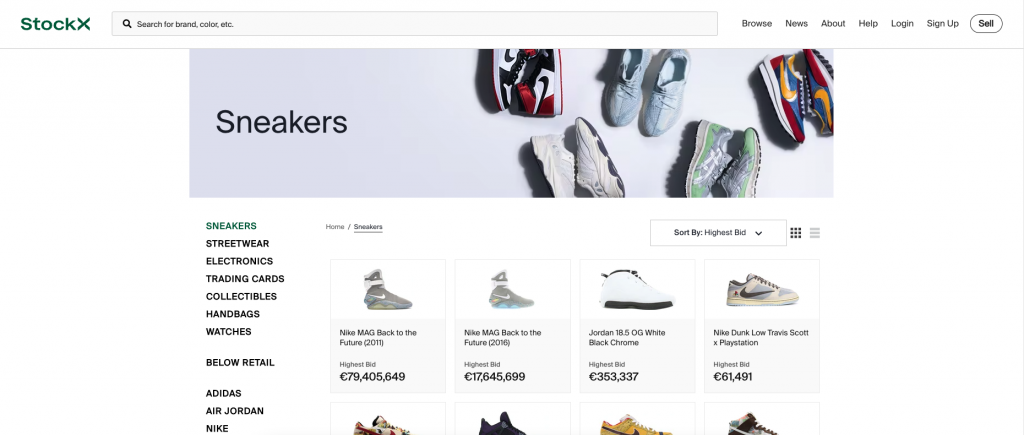

Did you know that there is an official sneaker exchange here, where sneakers are traded in values of tens of thousands of dollars?

Since there is even some price stability for some of these pairs of sneakers, this could thus be accepted as collateral.

DEFI example with sneakers as security

So let’s assume someone owns a pair of Jordan 1 Retro. On the stock exchange, this pair of sneakers has an average retail value of € 16,665.

With such extraordinary collateral, which is of course more volatile and also more illiquid than monetary security, gold, real estate, or similar, the loan to ratio value will be at least 300%. This means that with an average sale value of about 16,665€, the maximum loan that can be obtained is about 5,500€. But this is already the upper limit and if the price of the sneakers drops a little, the security is no longer sufficient and the loan would be liquidated. As it is also the case in the classic credit system.

So that this does not happen so quickly, we set ourselves a buffer and assume a loan-to-value ratio of 600%. So we take a loan of a maximum of approx. 2.700€.

So with that buffer in the collateral, the value of the pair of sneakers should drop by about 50% before the loan-to-value ratio becomes insufficient and we would be liquidated.

The exciting thing here, of course, is that such a procedure would not be possible in the classical financial system. No bank will accept a pair of sneakers, no matter how unique and valuable, as collateral for a loan.

However, in order to participate in the DEFI market, in this case, the pair of sneakers must be transferred to the blockchain universe to become collateral for a possible loan.

But, wait…

Let’s clarify a question that always comes up very quickly at this point: Why all this?

Why go to all the trouble of using collateral to borrow liquidity when you could turn the collateral itself into cash?

This question is justified and becomes even more pressing when the collateral itself already has a monetary character, like crypto.

In short, because you don’t want to give up the actual collateral – like the pair of sneakers in this case, or since we are in the blockchain universe, coins like BTC, Ethereum, and others.

Let’s say you own bitcoin worth €10,000.

Now you would like to participate in the DeFi market with 2,000€ and invest it there. However, you are also convinced that Bitcoin will continue to rise and therefore do not want to sell it to get your 2.000€ for the initial investment. In such a situation, it makes sense to deposit the 10,000€ Bitcoin as collateral, borrow 2,000€ against it and then invest it.

If Bitcoin now rises in value, your collateral grows, too. For example, to 12,000€. This means you can now borrow a little more against it, or you can leave it and thus increase your security and also reduce the risk of potential liquidation.

If you have then paid back the 2,000€, you get your Bitcoins back and thus also benefit from the grown value to 12,000€.

After we have clarified this question, let’s go back to the fact of how we can transfer these pairs of sneakers as collateral on the blockchain.

Ok, so we have now roughly explained how in the world of decentralized finance anyone can jump right in.

Either directly with the smallest amounts, even with 10€, or indirectly, in which one deposits an asset as collateral and then takes out a loan for it.

And all this without banks, and with much lower hurdles.

This is where the NFTs come into play.

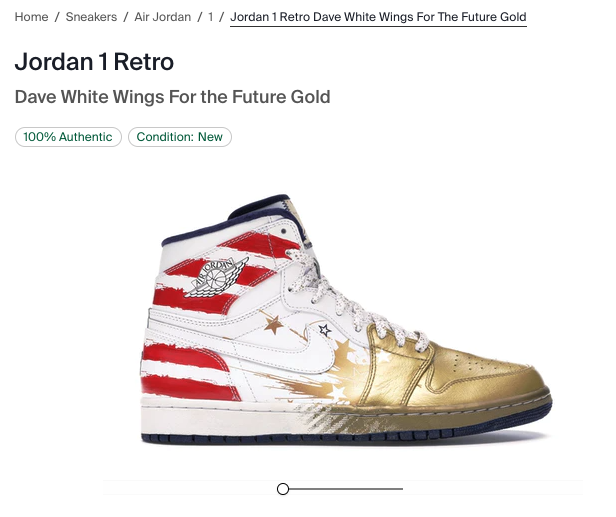

To do this, you create an NFT (you can read about how this works technically here, for example), which is considered the digital twin of the sneaker pair. Of course, this requires an official body that acts as the NFT creator and is trusted by all market participants. This already exists for the real estate market and also the classic car market. Even if I don’t know this for the sneaker market yet, an established player like stockx.com would definitely be suitable for this.

You send your pair of sneakers to stockx.com so that it can act as an intermediary and certify their authenticity and ownership. To do this, stockx.com issues an NFT that includes the serial number of the sneakers, the date, the name of the owner, and the current value of the shoes. Through so-called oracles, which can retrieve the current price of the sneakers directly from the stock exchange, this value can even be mapped in real-time in the NFT.

This NFT is then sent to the owner of the shoes on his digital wallet, from where he can deposit the NFT again at a DEX (decentralized financial exchange), as security.

In the end, NFTs are an effective way to represent digital assets to enable participation in a DEX as collaterals.

This inevitably brings us to the initial and final question of how gamified NFTs can be of benefit here.

Part 2

The more interested and motivated one is to participate in the decentralized financial market, the more exciting becomes the question of the type and value of the possible collateral to be deposited. In part 1 we talked about how perhaps in the future a pair of sneakers could be deposited as collateral.

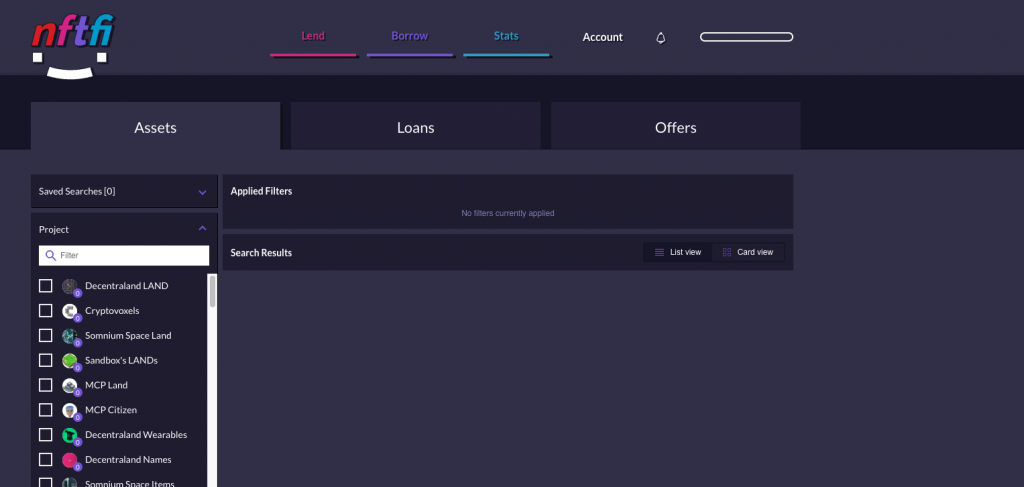

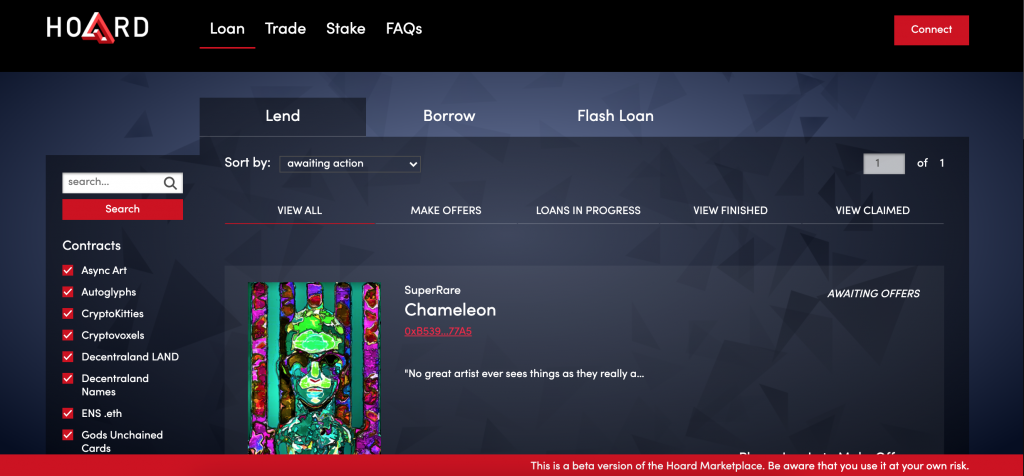

Services that understood and anticipated this trend early on are e.g. NFTfi.com and the Hoard Marketplace.

Here you can deposit your own NFTs as collateral from selected NFT projects and thus get a loan.

screenshot from nftfi.com

With the increasing success of NFTs and adaptation by the masses, other services will certainly offer a similar service here.

And that brings us to gamified NFTs.

By and large, all NFTs can be more or less gamified.

To see how gamification can help NFTs here, let’s look briefly at the mission and characteristics of gamification.

Gamification makes use of similar mechanisms that are already used natively in products such as online games, board games & card games. You can also find these mechanisms interestingly in activities like sports, music, or your hobby. In other words, everywhere where people are predominantly active voluntarily.

These mechanisms are so interesting because they make it easier for us humans to engage with tasks natively and intuitively.

Now as we are looking here at the topic of NFTs as collaterals, I can tell you that gamified NFTs could be a secret weapon to build up valuable collaterals.

This happens especially in the context of progress and achievements. We have already covered the power of Gamification and how it works e.g in this Youtube channel.

The more valuable an NFT is, the more suitable it is as collateral. This is not only about the pure nominal value, but also depending on the low volatility of the value and that as many people (or lenders) as possible see the same.

The value of an NFT can be determined either by its (in my honest opinion)

- de facto inherent monetary value

- value created by demand & supply

- rights and privileges associated with an NFT.

Let’s clarify these three possibilities:

De Facto Inherent Monetary Value

This is the simplest and most direct option. Assume that the NFT stands for a direct monetary value. Let’s assume, for example, that it is a 10 Bitcoin NFT. Thus, it would be clear, this NFT contains a private key to a wallet with 10 Bitcoin. This would make the value of the NFT as collateral very easy to determine and also to verify. Since you could deposit the 10 Bitcoin as collateral yourself, this would not necessarily be a sensible approach, but I think the idea behind it is clear.

Value Created by Demand and Supply

This is the classic example of a Samuel NFT. The best – current – example here is a Crypto Punk NFT or a Board Ape Yacht Club NFT. But for example also a digital NBA Topshot trading card.

For this kind of NFTs there are official marketplaces with a lively community. And because the pricing between supply and demand is very transparent here, you can easily find out the value of such an NFT in real-time.

Rights and Privileges Associated With an NFT

Depending on the conditions set by the NFT creator or owner, you can perform and fulfill tasks to ‚charge‘ your NFT with attributes. You can imagine this similar to an avatar from an online game. Depending on the actions of the player, this develops further. He becomes stronger, gets more resources, new skills or even handicaps and challenges. Exactly the same can apply to NFTs.

Let’s imagine that the music band U2 releases 100 NFTs. These NFTs provide access to a number of songs from the beginning that has not been released before. So, thanks to the NFT, you get early access to a few of the new songs from the next album.

To get these NFTs, you had to buy them at auction on one of the NFT exchanges, e.g. opensea.com.

Now, this is just the beginning of U2’s loyalty program.

With the receipt of the NFTs also came a list of challenges that one can pass as a true U2 fan. Examples would be:

- visiting old U2 venues

- collecting all U2 albums

- commenting and sharing articles about U2

- filling out certain questionnaires from concert promoters

- customizing your social media profile picture with a prepared U2 sign

- and much more.

There are almost no limits to creativity here.

With each achievement of one of these challenges, you get selected privileges or access to new challenges.

There can be rewards that are rather ’simple‘ like access to digital files, information, or the like. But there can also be very privileged achievements like

- a 1-hour skype call with the band members

- one-time backstage access at a U2 concert of your choice

- maybe even a lifetime concert ticket as the #1 prize

- 10% discount on your friend’s ticket

- access to discord or slack channel where only the top 50 people can see and vote on the new album cover

- and many more. Get crazy.

The owner of such an NFT can thus further develop the NFT through his own activities and, in accordance with the privileges thus obtained, also increase its inherent value.

Deposited as collateral, the value of the collateral has thus the potential also to increase and so, one could borrow a higher credit against it. Or improve his own loan-to-value ratio.

Be Smart And Use Gamified NFTs For Engagement

An issued gamified NFT is like an invitation (and a manual at the same time) from a brand/person/organization to its users & fans how to experience a journey together, and how to be able to progress within this journey in a game-like manner. This game-like asset is the secret to creating something that enables long-term engagement within communities that benefits from the intrinsic desire of people to be part of something bigger and to earn your place in it.

Think of such an NFT as the visual representation (similar to an avatar in a game) of a customer’s personal actions in a designed journey.

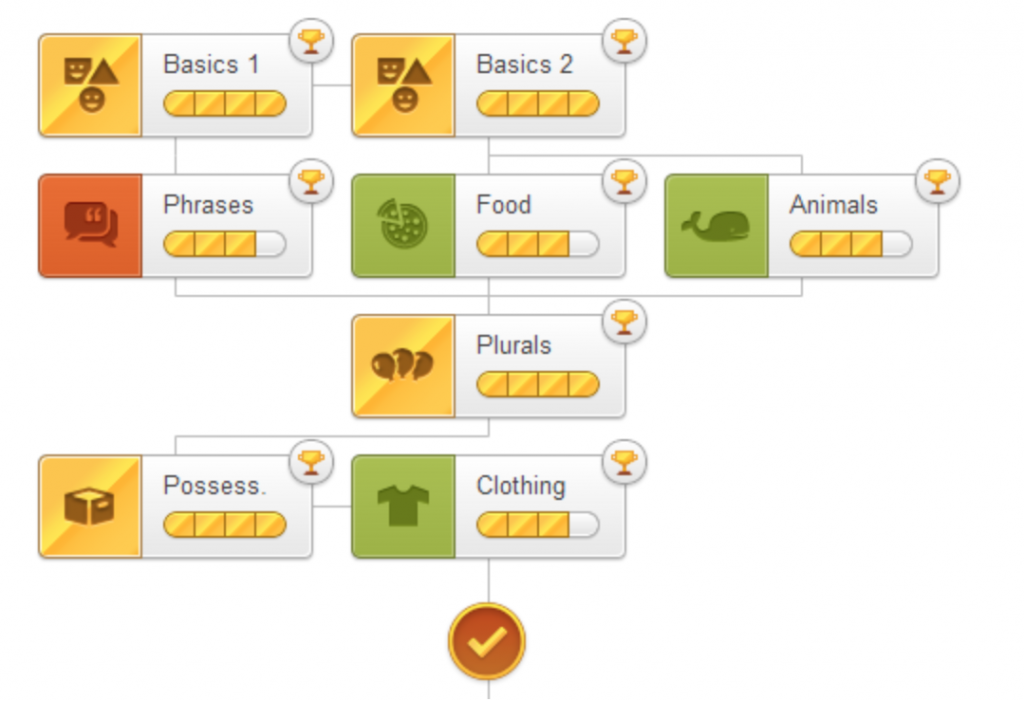

For example, you can design such a journey like a progress tree that unfolds over time in front of the player (customer).

Here is a simple visualized progress tree from the language learning app Duolingo:

As you complete set tasks and pass challenges(!), you progress up the progress tree. At the same time, your own NFT, as a representative avatar, charges up with the skills you have acquired.

According to its specificity and value for a particular community, the value of this NFT can increase accordingly.

Taken on its own, this already creates a community management design that frees itself from the dependence on classic extrinsic reward systems. Instead, it relies, similar to the role model of games, on the joint completion of exciting challenges within the framework of a superordinate story.

Be Even Smarter and Use it Also as a financial Asset

In the context of the DeFi discussed in this article, however, we now have an additional opportunity to turn this commitment as a customer or fan into a liquid asset. By increasing the value of the NFT through our gamified actions, we improve its position as collateral and can thus lend a more secure loan against it, which in turn can provide returns on the DeFi market. Either by staking, by liquidity mining, by lending or directly selling the entire NFT, or individual assets from the NFT, on the known NFT exchanges.

In this series of Gamification & NFTs have already appeared: